5 Ways to Prevent Small Business Fraud

Small businesses have enough hurdles to overcome as it is. They certainly don’t need to be concerned about being cheated out of existence.

Alas, small business fraud is real, and it’s not rare.

A 2018 Association of Certified Fraud Examiners (ACFE) report says that American businesses will on average lose about 5% of gross revenues to fraud. Worse: Small businesses (fewer than 100 employees) have a fraud frequency of 28%, compared to 22%-26% for different classes of larger organizations.

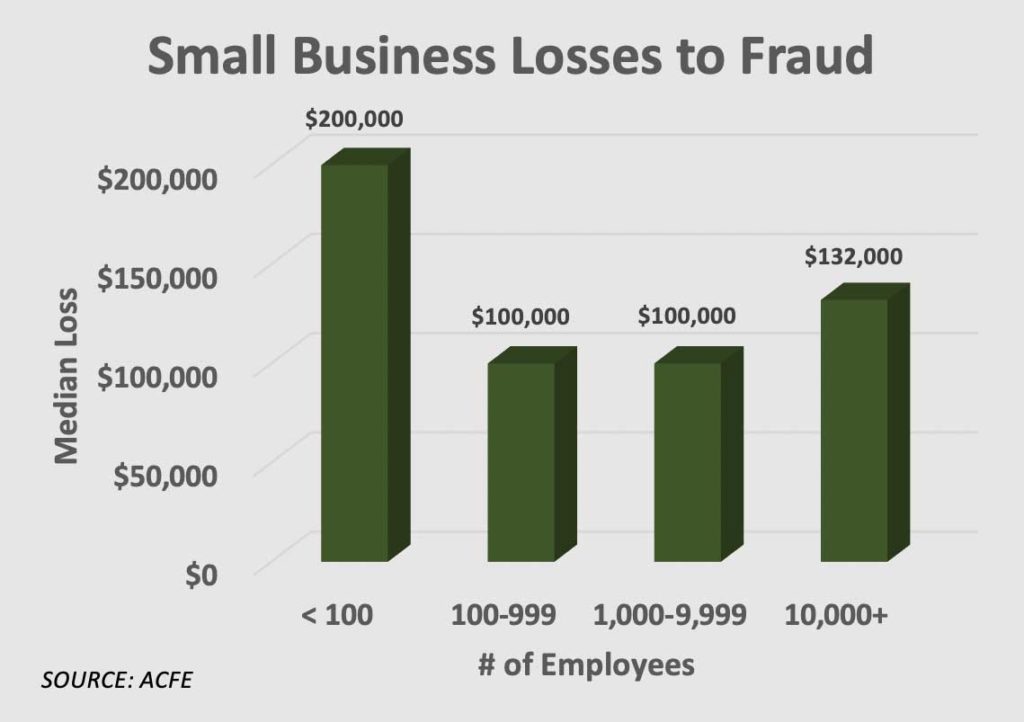

This isn’t petty theft, either. The ACFE writes “small businesses lost almost twice as much per scheme to fraud,” at $200,000 versus a $104,000 median across all other business sizes.

As any small business owner will tell you, losing $200,000 could be enough to put you out of business. So protecting yourself from small business fraud is of paramount importance.

Here, are some of the best preventative measures to consider.

5 Ways to Prevent Small Business Fraud

Create and maintain internal controls

The ASCE made it clear that lack of internal controls was a major factor in small business’ vulnerability. Its report stated that 42% of frauds were caused by lack of internal controls, versus just 25% for businesses with more than 100 employees.

One of the best such controls is segregating duties — for instance, the person who’s responsible for handling receipts and deposits should be different from the one reconciling bank accounts.

But internal controls can cover a wide range of practices, such as measures to monitor/limit petty cash; ensuring business assets are used for business purposes only; and keeping a close eye on company credit accounts.

Regularly audit/perform surprise audits

Businesses should routinely review the books to ensure that fraud isn’t occurring. Regularly monitoring cash, inventory, accounting and other areas can itself help discourage employees from committing fraud, too.

That said, you might be worried that a particularly ambitious fraudster might be gaming the schedule. If so, consider an occasional surprise audit to catch them off-guard.

Be vigilant with hiring

We know that bringing on more employees is challenging in and of itself. Simply finding an employee with a sterling resume and the right experience can be difficult and take time.

However, spend a little extra time to conduct background checks at this early stage. It can save you money and heartbreak by weeding out employees more likely to commit fraud.

Make employees take vacations

Make sure your employees occasionally unwind so they’re not overtaxed. This sensible policy works for two reasons.

For one, it’s a good overall business practice that makes your employees happy, and happy employees are less likely to try to steal.

However, you also can shine a light on fraud by monitoring differences in how business is handled while employees are away.

Talk to experts who can tailor a system for you

Fraud prevention is hardly a one-size-fits-all proposition. Fortunately, McManamon & Co., via our fraud and forensic services, can provide your company with an operational analysis to identify risk areas so you can better manage and mitigate those risks. We can also help design fraud deterrence systems, and assist in rolling them out.

Building and growing a small business is difficult enough. Don’t let someone cheat you out of your dream. Call us at 440.892.8900 or contact us online today.

Tags: fraud, McManamon & Co., small business, small business fraud | Posted in Fraud, McManamon & Co., small business