Economic Trends Impacting Small Businesses

No matter how locally focused a small business might or might not be, they still can be impacted by national and even global economic forces.

So as a small business owner, it pays to always have some idea of what’s happening around you on a macroeconomic level.

Today, we’re going to dive into several prominent economic trends that might be impacting some aspect of your small business’s costs or operations. We’ll also tap into JPMorgan’s commercial banking midyear outlook to discuss a few economic expectations that might color the months ahead.

1. Rising Interest Rates

A rapid and steep ascent in interest rates has undoubtedly increased the cost of doing business. The Federal Reserve has raised its benchmark Fed funds rate 11 times, to a current target range of 5.25% to 5.50%.

The Fed funds rate affects the rates on a wide range of products, including auto loans, mortgages and of course, small business loans. Any braking on that latter product can affect a wide variety of small business actions — buying large equipment, hiring, even borrowing to survive a rough patch.

If there’s any silver lining, it’s that the Fed’s rate hikes appear to be nearing an end. “We expect the Fed to be on hold through the middle of next year, provided inflation continues on its downward glide path,” says Ginger Chambless, Head of Research for JPMorgan Commercial Banking.

2. Inflation

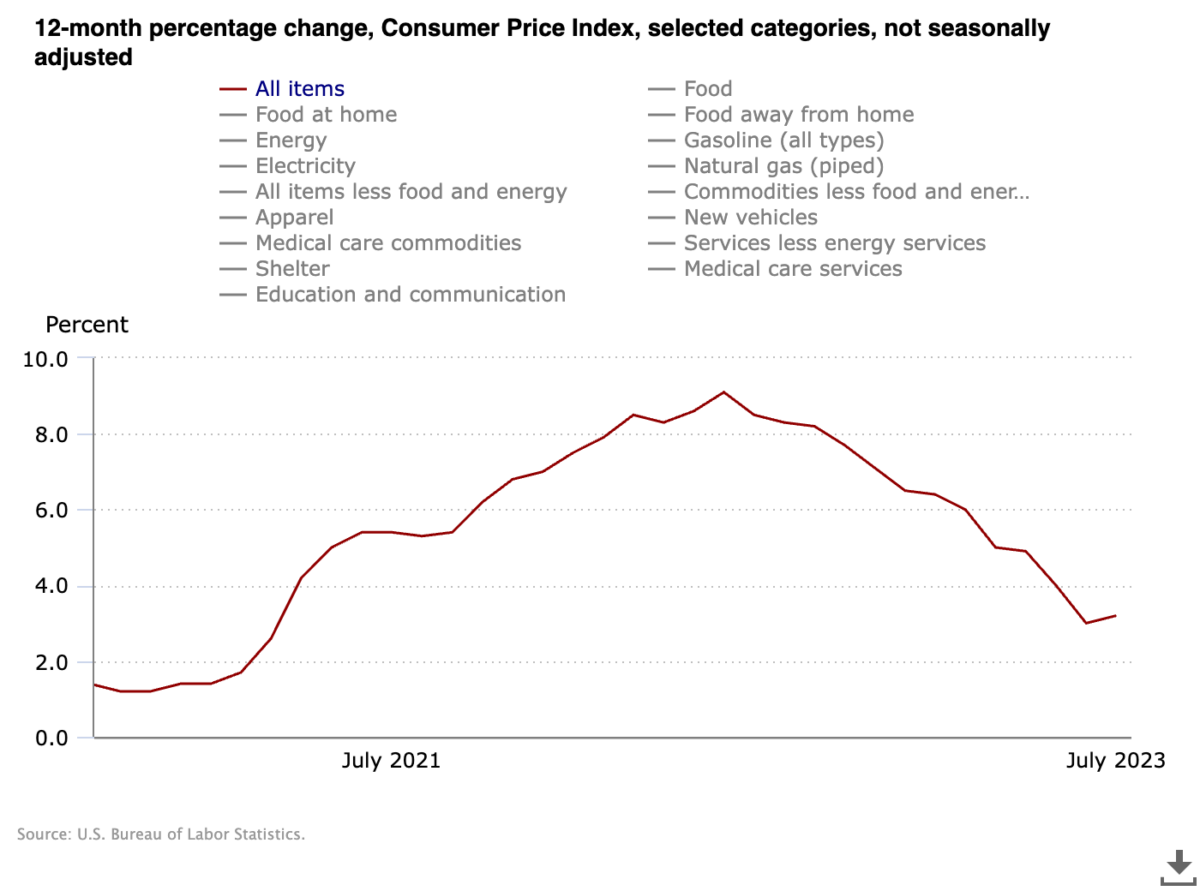

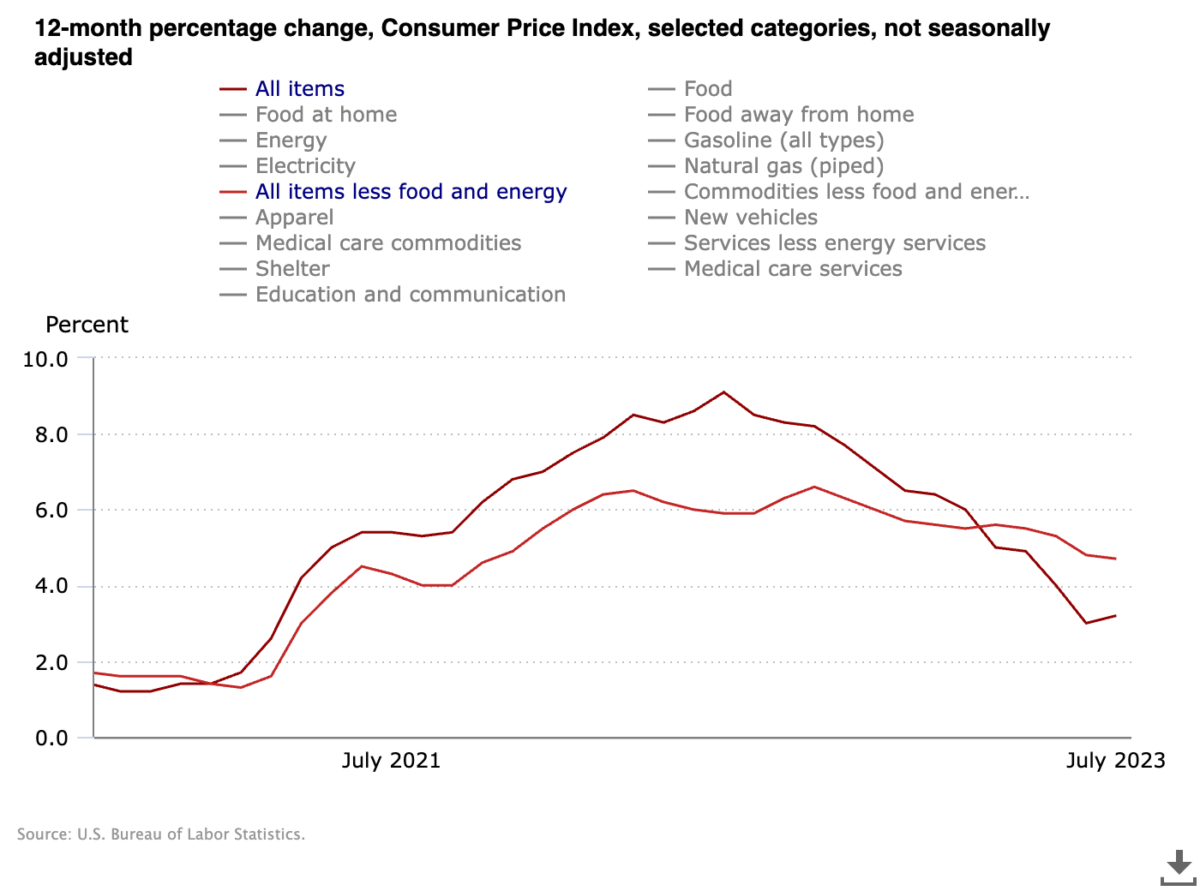

Speaking of inflation, the bane of most small businesses in 2022 has been on the retreat in 2023, as shown by the U.S. Consumer Price Index (CPI):

But it’s not as straightforward as it seems. One of the major downward pressures on inflation has been energy — however, core inflation, which excludes energy and food prices, isn’t coming down nearly so drastically.

Services and shelter, for instance, have still been rising at elevated levels — something that could continue pinching small business pockets for many months to come.

3. Recession Risks Fading

One of the biggest economic concerns heading into 2023 was the potential for the U.S. to fall into a recession. While some projections have merely pushed it back to 2024, there are growing signs of a potential economic “soft landing” (avoiding a recession). Gross domestic product (GDP), for instance, rose by 2.4%, which exceeded estimates for 2%, and is up from Q1’s 2% improvement. Both of these numbers show slower growth than we saw at the end of 2022, but they’re still positive, indicating a recession hasn’t settled in — at least not yet.

It’s not all great news, though — JPMorgan, for instance, still projects further slowing in GDP:

“If consumer spending moderates as we expect in the second half, growth could slow to low levels by early next year,” Chambless says. “We project real GDP to expand at a 2% pace in the second half of 2023 and 0.5% for the first half of 2024.”

But even that implies that the U.S. will escape recession in the near term.

4. Labor Market Showing a Little Slack

The labor market has been lock-tight for some time, driving up hiring costs that many small businesses are struggling to keep up with. But in recent months, some signs have emerged that the labor market is at least starting to cool:

- A 3.8% unemployment rate, while still historically low, is higher than it has been in 18 months.

- July job openings were the lowest since March 2021.

- The U.S. economy has added fewer than 200,000 jobs in each of the past three months.

- The U.S. nonfarm quit rate, at 2.3%, is broadly trending down and is lower than it was a year ago.

Small businesses should be encouraged. Large, publicly traded companies might be pressured to let go of additional headcount to keep margins higher. That could result in an influx of hirable talent.

5. Consumer Spending Headwinds and Tailwinds

The consumer spending outlook is best described as “mixed.”

Consumer confidence, for instance, recently rose to its highest levels since October 2021. And real income growth has been positive (that is, income has been outpacing inflation).

However, JPMorgan points out a few things that could hamper consumer spending:

“The tailwind of accumulated excess savings from the pandemic days continues to be drawn down, and we expect that support will be effectively finished by year end,” Chambless says, adding that “the restart of student loan payments this fall may add a slight headwind.”

Is Your Small Business Prepared for Economic Ups and Downs?

Is your business financially positioned to take advantage of economic booms and survive downturns? Do you know your business’s financial position?

If you’re not sure what your balance sheet is telling you, it’s time to talk to the accounting experts at McManamon & Co. We work closely with you to create financial statements, maintain records and provide expert guidance on financial accounting matters.

Reach out and find out what we can do for you and your business! Just call 440.892.8900 or contact us online.

Tags: accounting, economy, McManamon, McManamon & Co., small business, small business finances | Posted in McManamon & Co., small business, Small business finances