Study: The Best States for Starting a Small Business, 2024

If you’re starting a small business, you’re going to get to work on a great many things – writing out a business plan, finding funding and maybe hiring an employee or two.

But chances are that this career move won’t include relocating to another state. From that perspective, Lendio’s annual list of the best places to start a small business might not be very helpful. However, as a business owner, it’s important to understand the environment you’re working in, and whether that comes with any advantages. And from that perspective, Lendio’s list can provide a lot of insights.

Lendio’s Best States to Start a Small Business

For its 2024 list, Lendio examined 10 metrics “critical to the success of small business owners in 2024’s rapidly changing and uncertain landscape.” These 10 metrics cover business environment aspects including cost of living, tax rates, business incentives and more.

- Venture capital disbursed per $1 million of GDP (2022)

- Five-year startup survival rate (2018-23)

- 7a and 504 small business loans (2023)

- Small business financing offers through Lendio’s marketplace (Q3 2023-Q2 2024)

- Small business incentives (2023)

- Corporate income tax rates, on average, across tiers (2024)

- Educated worker mobility (2022)

- Hottest relocation markets (22)

- Personal consumption expenditures (2021-22)

- Median housing value of owner-occupied housing units (2022)

What Lendio Discovered

The top three states – Florida, Texas and North Carolina – stood out for their business-friendly climates, featuring low (or nonexistent) corporate taxes, an influx of residents, accessible funding and substantial consumer spending.

Florida – which moved from No. 2 in 2023 to the top spot this year – not only has a low 5.5% corporate tax rate, but it also has no state income tax, which helps attract a larger talent pool. It’s also the 12th highest recipient of SBA loan dollars, second in number of loan offers facilitated through Lendio’s marketplace, and has had more than half of its startups survive for at least five years.

Texas, meanwhile, not only has no individual income tax, but also no corporate taxes (though it does have a state gross receipts tax), helping buoy both business survivability and an influx of skilled workers. North Carolina has a very low 2.5% corporate tax rate, low housing costs and an above-average business survivability rank.

On the back end of the list … Nebraska, New Hampshire and Hawaii represent the bottom three. Lendio says these low rankings are “due to low business funding and venture capital availability, limited local incentive programs, high tax rates and high cost of living.”

Overall, high rankings often were the product of heavy migration and reasonable costs of living. Lendio cites availability of business funding, venture capital, and local incentive programs as “important factors that impacted the rankings.”

The Top 10

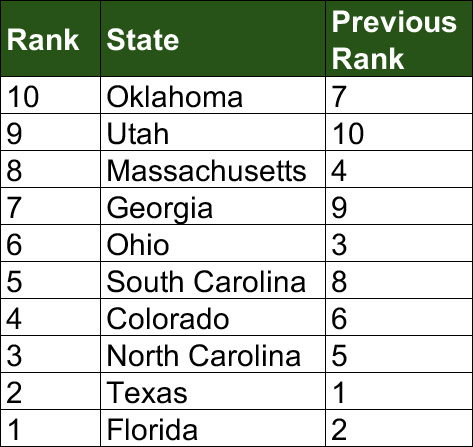

Here’s a quick look at the top 10 states overall:

Looking to Start a Small Business? Start on the Right Foundation.

You can see the full set of findings at Lendio, but the company notes that “wherever you work, each state presents opportunities and challenges.” In other words: Location is something, but it’s hardly everything.

If you’re looking to establish your business on stable footing, it’s wise to talk to the pros.

McManamon & Co. specializes in small and midsize business. We offer a broad spectrum of consulting services, from preparing SBA loan packages to assisting in strategic planning, that fortify our clients’ businesses and keep them operating on the highest level.

Are you an entrepreneur that wants to build a budding business? Call us at 440.892.8900 or contact us online today.

Tags: McManamon, small business, small business finances, small business owner, startups | Posted in McManamon & Co., small business