Tax Changes Coming to the Table in 2025

The tax code is constantly in a state of flux, which is why staying compliant is such a headache. Every year, small business owners who do their own taxes have to catch up with the latest rule additions, phase-outs and expirations pertaining to deductions, credits and more.

Our advice? Don’t play catch-up — instead, be proactive. That means not just staying on top of the latest tax changes, but keeping an eye on potential tax discussions and decisions that could turn into new policy.

This advice carries even more weight in 2025, as a new administration takes control of Washington with a number of tax policies already on its wish list.

Today, we want to shine a light on both new tax policy taking effect in 2025, as well as tax changes that could be coming down the pike. We’ll start by highlighting a couple important shifts that are set to take effect this year, then move on to tax proposals that could come into the picture sooner rather than later.

2025 Changes

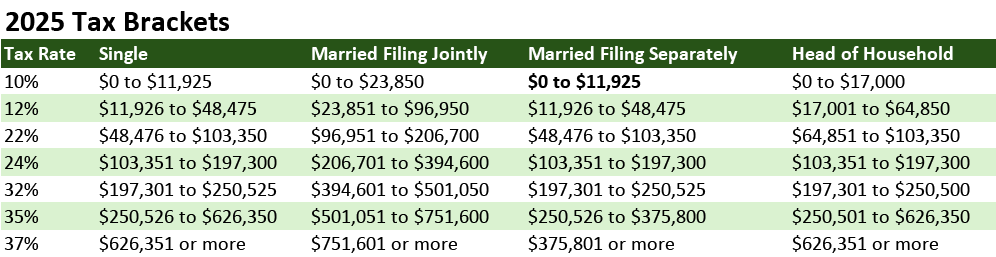

2025 Tax Brackets

First things first: The federal tax brackets have largely been expanded to reflect changes in inflation. Here’s a look at the 2025 tax brackets, which apply not just to individual taxpayers, but also several business structures, including sole proprietorships, partnerships and S corps.

2025 Standard Deductions

Standard deductions will also be larger in 2025:

- Single and married filing separately: $15,000 (up $400 from 2024)

- Married filing jointly: $30,000 (up $800 from 2024)

- Heads of household: $22,500 (up $600 from 2024)

2025 Retirement Plan Contribution Limits

The 2025 contribution limit for 401(k)s (which also applies to 403(b)s and 457s) is $23,500, up from $23,000 in 2024.

Older workers can make “catch-up” contributions, too; however, there’s a new wrinkle to these in 2025. In 2024, anyone age 50 and older could put an additional $7,500 into their 401(k). In 2025, anyone age 50 to 59, and 64 and older, can still make up to $7,500 in additional contributions (for a total limit of $31,000), but those age 60 to 63 can enjoy an even higher contribution limit of $11,250 (for a total limit of $34,750).

Individual retirement account (IRA) limits were unchanged, remaining at $7,000. IRAs’ catch-up contribution limits also didn’t budge, adding another $1,000 (for a total limit of $8,000).

2025 Tax Discussions to Watch

A large number of tax changes could be en route in 2025, as Republicans have gained control of both the White House and both houses of Congress. However, none of the following potential changes are concrete — they merely reflect policies that have been proposed by President-elect Donald Trump and his party.

TCJA Extension

The Tax Cuts and Jobs Act (TCJA), which was passed in 2017, enacted a number of significant changes to both the personal and business tax codes. However, some of the TCJA’s provisions have begun to sunset, and most of the TCJA is set to expire at the end of 2025.

That said, the incoming president and the Republican Party have already made a number of proposals related to the TCJA — proposals that could be among some of the new administration’s highest priorities.

Among them:

- Extend or make permanent the individual income tax rates, which as of right now are set to expire at the end of 2025.

- Alternatively, Trump has also proposed eliminating the current income tax system.

- Reduce the corporate income tax rate from 21% to 20% for all companies, and to 15% for companies that manufacture in the U.S.

- Extend or make permanent the larger standard deduction.

- Extend 20% Qualified Business Income (QBI) deduction, which as of right now is set to expire at the end of 2025.

- Eliminate $10,000 cap on state and local tax deductions (SALT).

- Extend lifetime gift and estate tax exemption threshold, which was lifted from $5.49 million before TCJA to $13.61 million after TCJA. Higher exemption threshold is set to revert to pre-TCJA levels at the end of 2025.

- Extend carried interest rule, which treats carried interest as a long-term capital gain if held over three years. Rule is set to expire at the end of 2025.

- Reinstate 100% bonus depreciation, which is sunsetting from 100% through Jan. 1, 2023, by 20 percentage points each year until it phases out as of Jan. 1, 2027.

IRA Repeals

Republicans have also expressed interest in cutting at least parts of the Inflation Reduction Act (IRA), which allocated almost $370 billion to clean-energy and climate-related projects over a 10-year period.

Repealing the act wholesale could prove difficult given that the IRA has already begun creating jobs — briskly in several Republican states.

However, the new administration could target several related tax credits, including the Clean Vehicle Credit, Clean Electricity Production Credit and Clean Fuel Production Credit, among others.

Tariffs

One of the biggest wild cards entering the year is the president-elect’s enthusiasm for tariffs.

Already, Trump has proposed …

- A 60% tariff on Chinese products

- A 25% tariff on Mexican and Canadian imports

- A blanket tariff of 10% to 20% on imports from all countries.

In late 2024, businesses were already altering their buying activity to hedge their bets in case Trump does push through some or all of his proposed tariffs. Tariffs could significantly hike businesses’ costs of importing a variety of components and products – and those costs very well could get passed along to consumers.

Let Us Keep Tabs on Taxes for You

Of course, small business owners have a lot on their plates. They typically don’t have time to keep up with the rapidly changing tax landscape — let alone look ahead to mere discussions and speculation on tax policy.

But if you have McManamon & Co. on your side, you don’t need to.

McManamon & Co. provides creative, innovative and proactive tax advice that keeps your company on Uncle Sam’s good side. Our tax strategies incorporate vigilance and forward planning to keep you in control of your tax situation. We routinely project upcoming tax liabilities and make recommendations to minimize and defer pending liabilities.

If you want to make sure your company is always prepared for what the IRS throws your way, call us at 440.892.8900 or contact us online.

Tags: McManamon, McManamon & Co., small business, small business taxes, tax news, tax reform, taxes | Posted in McManamon & Co., small business, small business taxes, taxes