IRS Announces 2016 Tax Rates, Standard Deductions, Exemption Amounts & More

As always we appreciate your business during the tax season and beyond. For many accountants, tax season does not end until the final due date deadline of October 15. However, now is the time to start thinking about your 2016 tax situation, and if any changes are needed to adequately prepare you for any possible tax liability.

If you receive your health insurance through either the federal or state exchange, it is imperative that you review your information regularly. One of the biggest challenges we faced this tax season was unexpected tax bills due to the Affordable Care Act. If the information provided to Healthcare.gov is not accurate, it could result in the total disallowance of the premium tax credit.

Of major concern to the IRS is the challenge to combat identity theft and refund fraud. Practitioners are facing many challenges in providing adequate protection for their clients. If you are asked to provide additional information or documentation, it is for your protection. The tax software companies and the IRS are installing additional security protocols to assure the accuracy of the tax returns being filed.

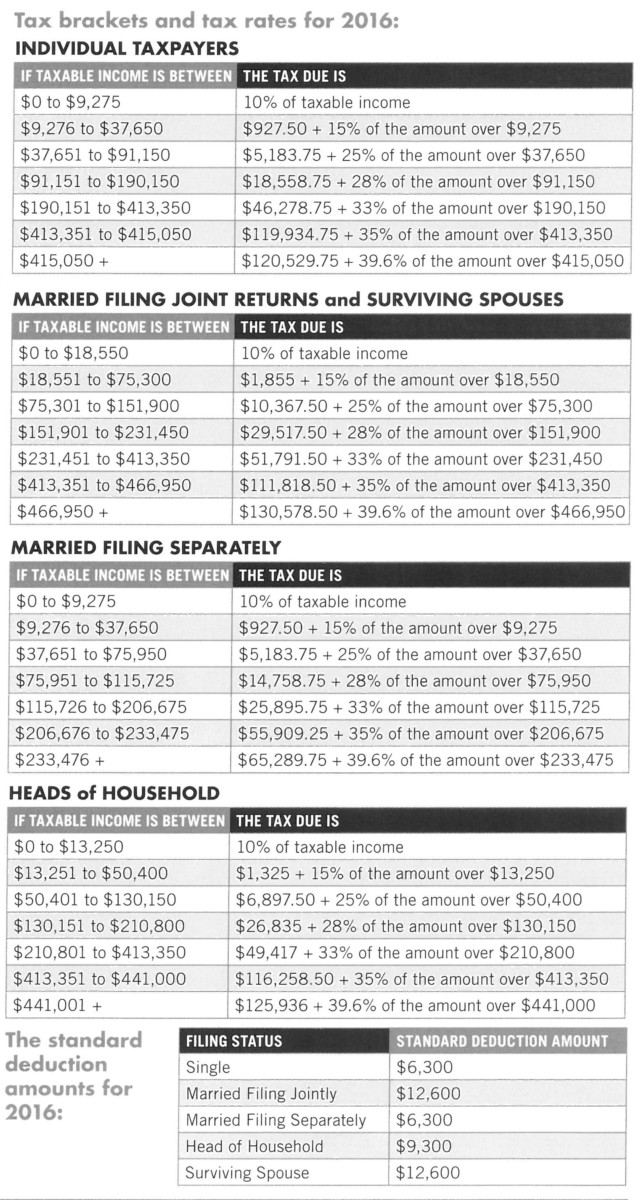

The following are selected tax brackets, tax rates for 2016 and a brief description of the tax consequences. Please contact our office if you have any questions regarding these tax provisions and how they may affect your tax return.

Tags: 2016 tax rates, accounting, taxes | Posted in accounting, taxes